The Emergence and Growth of HNWIs in Asia

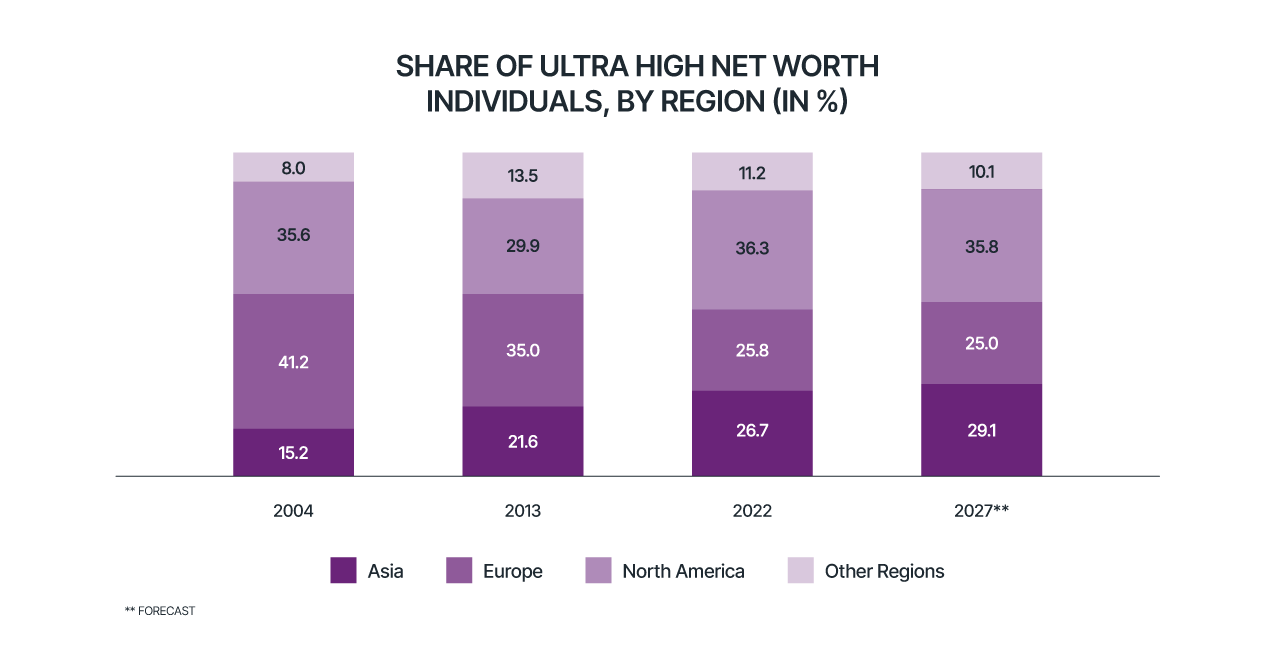

Over the past two decades, Asia witnessed a rapid economic surge in the number of high net-worth individuals, positioning the region as one of the global wealth powerhouses. Driven by thriving economies, innovative industries, and a booming entrepreneurial spirit, countries like China, India, and several Southeast Asian nations have seen their wealthy elite grow at an unprecedented rate. According to Statista, a global data and business intelligence platform, Asia accounts for over 25% of the world’s HNWIs today, a testament to its meteoric rise in wealth creation.

What sets Asia apart is the sheer pace and scale of this transformation. For instance, according to Statista, while ultra-wealthy populations are predicted to increase across all world regions, Asia is forecast to see the strongest growth over the next 5 years, surging from 395,070 to 528,100 high net-worth individuals. This explosive growth has outpaced traditional wealth hubs like Europe and North America, establishing Asia as the new epicenter of global wealth, due to big economies such as India, China, and other South Asian countries. Yet, this rapid accumulation of wealth has also brought its own set of challenges, prompting many HNWIs to seek stability and security beyond their home countries.

What sets Asia apart is the sheer pace and scale of this transformation. For instance, according to Statista, while ultra-wealthy populations are predicted to increase across all world regions, Asia is forecast to see the strongest growth over the next 5 years, surging from 395,070 to 528,100 high net-worth individuals. This explosive growth has outpaced traditional wealth hubs like Europe and North America, establishing Asia as the new epicenter of global wealth, due to big economies such as India, China, and other South Asian countries. Yet, this rapid accumulation of wealth has also brought its own set of challenges, prompting many HNWIs to seek stability and security beyond their home countries.

However, recent years have introduced a wave of uncertainties, leading HNWIs to reevaluate their futures and consider a second passport as a safeguard. Economic slowdowns, political upheavals, and shifts in regulatory environments have sparked concerns. Adding to these worries are environmental challenges like poor air quality in China and India, and political instability in parts of South Asia. These factors have driven HNWIs to look for safer and more stable environments for themselves and their families.

Despite these headwinds, the desire for a better quality of life remains strong. Europe, with its robust economies, political stability, and attractive investment opportunities, has emerged as a prime destination for Asian HNWIs. Programs like the Golden Visa programs in Portugal, Spain, and Greece have seen a surge in interest, as they offer not just residency, but a promise of security and a higher standard of living. This dynamic shift is reshaping global wealth patterns since Asia’s HNWIs are not just seeking refuge; they are actively investing in their futures, adapting to the changing landscape with a keen eye on long-term growth and sustainability. For the region's wealthy elite, the pursuit of prosperity now extends beyond borders, as they continue to build legacies that transcend continents.

Key Reasons Behind the Migration of HNWIs to Europe

Economic Instability and Uncertainty

One of the primary drivers of this migration is economic uncertainty. While Asia's economies have overgrown, they have also faced significant volatility. Trade tensions, currency fluctuations, and stock market instability have all created an uncertain environment. For HNWIs, whose wealth is often closely tied to market performance, such instability can be a strong motivator to seek safer havens.

Political and Regulatory Challenges

Political instability and regulatory changes are also significant factors. In less democratic Asian countries, increased government intervention in business and tighter regulatory controls have raised concerns among the wealthy. Policies such as capital controls and restrictions on business practices can make the economic environment less hospitable for HNWIs. This is also true in other countries that are seeing a rise in HNWIs but struggling to provide the stability these individuals seek.

A striking example is the United States, the world's largest economy. Recently, several companies left San Francisco for Texas due to high taxes in California. The situation becomes even more complex when we see a significant number of individuals leaving the U.S. for Europe, particularly during election periods; a time of considerable uncertainty in a country that should ideally offer peace and stability for its citizens.

The same effect has also been seen in recent years in Hong Kong. Once a thriving business hub known for its low taxes and favorable conditions for entrepreneurs, Hong Kong has seen a wave of companies relocating due to increasing challenges. Rising political tensions and tighter regulatory controls have significantly impacted the business environment, leading many multinational firms to reconsider their presence in the region. Additionally, recent tax reforms have made Hong Kong less competitive compared to other global financial centers. The introduction of stricter compliance measures and higher operational costs has further strained businesses, particularly in the finance and technology sectors.

As a result, many companies are opting to move their operations to more stable and business-friendly locations like Singapore and Dubai, where they find a more predictable regulatory environment, lower taxes, and better overall conditions for conducting business. This exodus is reshaping the economic landscape of Asia, highlighting the need for Hong Kong to reassess its policies to retain its status as a leading international business center.

Quality of Life and Lifestyle Preferences

Relocating an entire company to a more business-friendly country can be advantageous from a professional standpoint, but it’s important to consider whether the destination also offers a high quality of life. Lifestyle and personal preferences are crucial factors when individuals decide where to move their families.

Many HNWIs seek a more stable and enjoyable quality of life, which they believe European countries can offer. Europe is renowned for its excellent healthcare systems, world-class education, and high standard of living, making it an attractive alternative. Rankings of quality of life consistently place European countries at the top, offering safety, stability, and a favorable environment for raising families.

When it comes to safety, for example, 7 European countries rank in the global top ten, while the U.S. and China rank much lower. In terms of university rankings, Europe also performs exceptionally well, while countries like India struggle to make the top 100. Furthermore, Europe consistently ranks high in air quality and environmental stability, underscoring its appeal as a place to settle permanently. These factors weigh heavily in favor of the continent when HNWIs consider acquiring a second passport.

Preferred European Destinations for HNWIs

As HNWIs seek refuge in Europe, several countries have emerged as top choices. The United Kingdom, despite Brexit uncertainties, remains a favorite due to its global financial hub status and high-quality lifestyle. Switzerland, known for its financial secrecy and stable economy, is also a popular choice. Spain and Portugal are attracting those looking for a more relaxed lifestyle with favorable tax regimes and stunning landscapes, as well as Greece. The last 3, for instance, offer one of the best residency-by-investment programs in the world: the Golden Visa.

Since October 2023 Portugal discontinued its Golden Visa Real Estate option, but still offers other options such as the Investment in Venture and Equity Fund Capitals. As for Greece and Spain, Real Estate is still an option (recent news have confirm the government intention of ending the Real Estate option), and what an option. Not only does the investor manage to gain residency and later on a second passport, but also gains a great investment with a real estate property in those countries being profitable for years.

The United Kingdom: A Financial Powerhouse

London, as a global financial center, continues to attract wealthy individuals from around the world. The city’s world-class amenities, prestigious educational institutions, and vibrant cultural scene make it a top destination for HNWIs. The United Kingdom also offers a favorable business environment with access to a vast network of financial and professional services, making it ideal for entrepreneurs and investors looking to expand their portfolios.

Despite the uncertainties surrounding Brexit, the UK remains resilient, with London maintaining its position as a key hub for global finance.

Spain: A Blend of Culture, Climate, and Opportunity

Spain offers a relaxed lifestyle that appeals to many HNWIs seeking a balance between work and leisure. With its warm climate, beautiful coastlines, and relatively favorable tax policies, Spain is a popular choice for those looking to enjoy a high quality of life.

Spain's Golden Visa program is one of the most attractive in Europe, offering a straightforward path to residency for investors. To qualify, applicants must invest a minimum of €500,000 in Spanish real estate, with options to invest in other areas like government bonds or Spanish companies. The application process is relatively quick, usually taking around two to three months. The visa allows for free travel within the Schengen Area and provides a pathway to permanent residency after 5 years and citizenship after ten years, provided the investor maintains the investment and meets the residency requirements.

Portugal: A Gateway to Europe with Unique Benefits

Portugal has become a hotspot for HNWIs due to its favorable tax regime, stunning landscapes, and high quality of life. The Portuguese Golden Visa program has been particularly popular, though recent changes have shifted focus away from real estate investment to other avenues like Venture and Equity Funds. Despite these changes, Portugal remains a top choice for those seeking a peaceful and prosperous environment.

The Portuguese Golden Visa program requires a minimum investment of €500,000 in Venture Capital or Equity Funds. The process typically takes about 6 months (due to the recent delays, it can go up to 18 months), and visa holders must stay in Portugal for at least 7 days in the first year and 14 days in the subsequent two-year periods. After 5 years, the investor can apply for permanent residency, and after 6 years, they can apply for citizenship, provided they have basic knowledge of the Portuguese language and meet other requirements.

Greece: A Mediterranean Paradise with Strategic Appeal

Greece is emerging as a favored destination for HNWIs seeking a blend of natural beauty, rich history, and economic opportunities. The country’s Golden Visa program offers a straightforward path to residency through real estate investment, making it an appealing option for those looking to secure a second passport. The Greek economy, while still recovering from past crises, presents unique investment opportunities, particularly in tourism, real estate, and renewable energy. With its beautiful islands, vibrant culture, and strategic location, Greece is becoming an attractive choice for those looking to invest in a Mediterranean lifestyle.

The Greek Golden Visa program offers one of the most affordable pathways to European residency. Applicants can invest a minimum of €250,000 in real estate, one of the lowest thresholds in Europe (please check the conditions for this type of investment). The process is relatively fast, taking about three months to obtain residency. There are no residency requirements to maintain the visa, making it highly flexible for investors. After 7 years of holding the visa, individuals can apply for citizenship, provided they meet the necessary residency and integration requirements.

The Impact of HNWI Migration on European Markets

Rising Demand and Prices in Real Estate

The demand for high-end real estate has led to increased property prices in several European cities. This trend is particularly evident in prime locations such as London’s Mayfair and Paris’s 16th arrondissement. The luxury property market is experiencing heightened activity, with HNWIs investing in both residential and commercial properties.

The influx of HNWIs into Europe has had noticeable effects on the region's markets. In cities like London and Geneva, demand for luxury properties has surged, driving up prices and altering market dynamics.

Investment in Diverse Sectors

European financial markets are also benefiting from this influx. HNWIs are investing in various sectors, including technology, healthcare, and renewable energy. This investment is fueling growth and innovation across the continent.

Challenges and Opportunities for Europe

While the migration of HNWIs presents opportunities for Europe, it also brings challenges. The increased demand for luxury properties can drive up prices, potentially making housing less affordable for residents. Additionally, the rapid influx of wealthy individuals can strain infrastructure and services in some areas.

On the other hand, HNWIs bring substantial investment capital, which can boost local economies and create job opportunities. Their presence can also enhance the global profile of European cities as financial and cultural hubs. In Portugal, for example, it is stated by the government official sources that the Golden Visa program already brought to the country's economy over €7 billion.

Future Trends and the Role of Investment Visa Professionals

Looking ahead, the movement of HNWIs from Asia to Europe is likely to continue. Economic and political uncertainties in Asia, coupled with Europe’s appeal as a stable and desirable destination, suggest that this trend will persist.

Navigating these shifts and making informed decisions requires expert guidance. Investment Visa’s team excels in providing up-to-date information and strategic advice on this evolving landscape. With a deep understanding of global trends and the intricacies of investment opportunities, they are your go-to resource for staying ahead in the dynamic world of wealth migration. For comprehensive insights and personalized support, contact us today and get your first meeting with our advisors.